Alternative investments include various assets and strategies, but they usually have these traits:

- They’re not closely connected to regular investments like stocks and bonds

- They can offer higher returns than traditional investments

- They often involve unusual and sometimes hard-to-sell assets

- You might have to keep your money invested for a while before you can take it out

- They can be complicated in how they’re set up and how much risk and return they offer

Different alternative assets have different benefits and risks – you can learn more about the specific details of different asset classes using our resources. But this blog will explore the core benefits and risks associated with alternative assets more generally.

Benefits of Alternative Assets

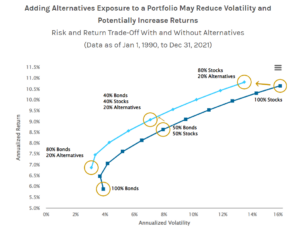

● Potential reduction in overall volatility

Imagine you have a portfolio heavily invested in stocks. A sudden market downturn could lead to significant losses. However, by allocating a portion of your portfolio to alternative assets, which historically has a lower correlation with traditional assets, you could reduce the overall volatility of your investment portfolio.

Source: Morgan Stanley

● Diversification

By spreading your investments across various strategies, investment styles and asset classes, you can reduce the risk of your portfolio being too reliant on the performance of any single asset or market.

To learn more about the benefits of diversification, click here.

● Potential for increased performance

Alternative assets have the potential to generate ‘alpha returns’ – which are returns that exceed those of traditional assets.

For example, our SBF investment notes have returned 100% of their target returns to our investors, and can return a monthly, quarterly, or 24 month maturity dividend payment.

Risks of Alternative Assets

● Illiquidity

Alternative investments are typically less liquid compared to traditional assets. This means they can be challenging to sell quickly, and you can risk your investment being tied up for extended periods.

Examples of illiquid alternative assets include private equity, venture capital, and certain types of real estate investments.

● Complexity

Alternative investments can be complex and often require more due diligence. Understanding the specifics of these investments, such as potential tax implications, is key.

Our own small business finance notes can be invested through your IRA accounts through multiple providers, bringin obvious tax benefits to your or your clients.

How do I know which alternative assets to invest in?

When it comes to alternative assets, one size doesn’t fit all. It’s important to match specific investment strategies with each investor’s personal risk tolerance.

A good way to understand your risk tolerance is to clarify your main investment objectives. Do you want to grow wealth quickly? Or have a stable, reliable income?

Understanding your overall goal can help you determine which alternative assets align best with your unique preferences and objectives.

What can I do now?

Investing in alternative assets can offer benefits like diversification and hedging against market volatility, alongside potential drawbacks such as illiquidity and complexity.

Sign up for our free investor account to learn more about alternative assets and how you can incorporate them into your portfolio.

Our existing investors can reinvest directly into our two brand new note products: the 24 month 14% note and the 36 month 15% note.