By the numbers

Since inception, Supervest’s Notes, SV Mid-Term Note I & SV Short-Term Note I, have performed as expected making all scheduled interest payments on time and in full. The strong performance of our notes is due to a number of factors, including Supervests ability to partner with strong Funding originators and the expertise to discern the quality deal investments that underlie the notes portfolio. Additionally, Supervest has introduced aspects of machine learning into its individual deal valuation for portfolio consideration with great success. The team will continue to evaluate and explore the use of both machine learning and artificial intelligence as a compliment to its traditional fundamental approach.

Supervest notes offer higher yields than traditional passive income investments along with a steady stream of quarterly payments. In an environment where inflation remains elevated, investors are looking for investments that can provide them with a hedge against inflation. Diversification across industry classes and duration has also been a key to performance. This helps to reduce risk, as any specific weakness in one industry will have less effect on the overall portfolio. Managing term and duration attempts to optimize the benefits of turnover velocity while maintaining a strong core of lower risk deal investments.

Our notes provide consistent and steady payments that enhance growth compared to volatility associated with traditional investments. In an environment where volatility is nearly constant, investors are looking for investments that have greater certainty to grow in value.

The Supervest Notes continue to pay all interest payments and principal to date since inception.

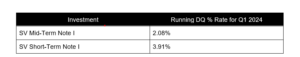

Running Delinquency Rate*

*This metric represents the % of original RTR that is without payment for at least 30 calendar days. This % is subject to fluctuation as the portfolios continue to season.

SV Mid-Term Note I

Min. Investment: $25,000 | Term: 24 Months | Payment Schedule: Quarterly

Investor AUM: $7.7M

(as of 3/31/24)

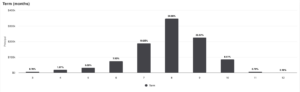

Term (months)

Close to 80% of deals have a term of 6 – 10 months.

Principal by Industry

Leading industries by AUM are: Contractors – Tradesman, Business Services, and Restaurant / Bar / Food Service

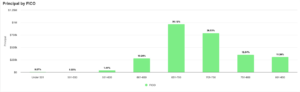

Principal by FICO

Close to 90% of the note is currently invested in deals with FICOs over 650.

SV Short-Term Note I

Min. Investment: $25,000 | Term: 12 Months | Payment Schedule: Monthly

Investor AUM: $1.3M

(as of 3/31/24)

Term (months)

More than 90% of deals have a term of 6 – 9 months.

Principal by Industry

Leading industries by AUM are: Contractors – Tradesman, Restaurant / Bar / Food Service and Business Services.

Principal by FICO

More than 80% of the note is currently invested in deals with FICOs over 650.