By the numbers

| Investment | Target Annualized Return | Realized Annualized Return |

| SV Mid-Term Note I | 12% | 12% |

| SV Short-Term Note I | 10% | 10% |

Since its inception, Supervest’s Notes, SV Mid-Term Note I & SV Short-Term Note I, have consistently met all scheduled interest payments promptly and in full. This strong performance is attributable to several key factors, including Supervest’s adeptness in partnering with robust funding originators and its proficiency in identifying high-quality deal investments that underpin the notes portfolio.

Supervest’s notes offer investors higher yields compared to conventional passive income investments. With the ongoing rise in inflation, investors seek avenues that can serve as a hedge against inflationary pressures. Furthermore, our strategy of diversifying across various industry classes has been pivotal in enhancing performance. This diversification strategy mitigates risk, as a downturn in one industry class is less likely to significantly impact the overall portfolio.

The consistency and reliability of our notes translate into stable payments that promote growth, offering a contrast to the volatility often associated with traditional investments. In a landscape where market fluctuations are frequent, investors increasingly seek investments that provide a higher level of predictability in terms of value appreciation.

In summary, Supervest’s notes have consistently met expectations and continue to offer investors a reliable and attractive investment option.

Running Delinquency Rate*

| Investment | Running DQ % Rate 3Q 2023 |

| SV Mid-Term Note I | 5.08% |

| SV Short-Term Note I | 4.62% |

*This metric represents the % of original RTR that is without payment for at least 30 calendar days. This % is subject to fluctuation as the portfolios continue to season.

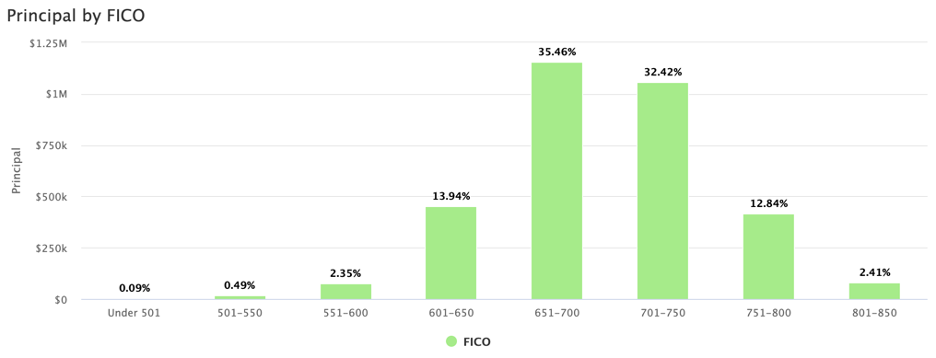

SV Mid-Term Note I

Min. Investment: $25,000 | Term: 24 Months | Payment Schedule: Quarterly

Investor AUM: $5.68M

(as of 9/30/23)

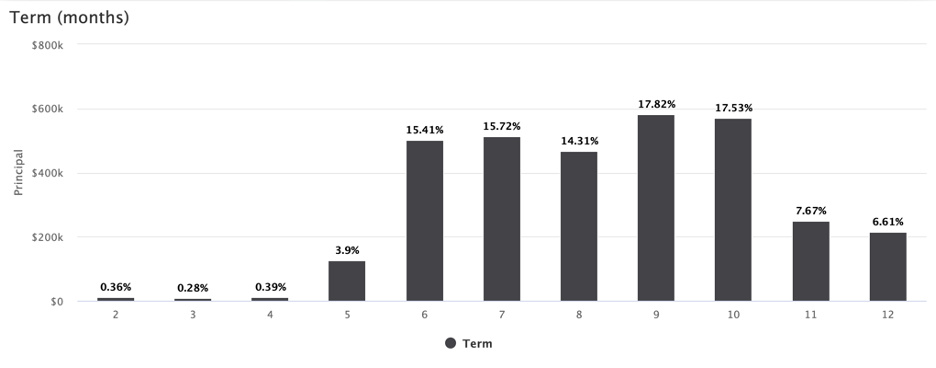

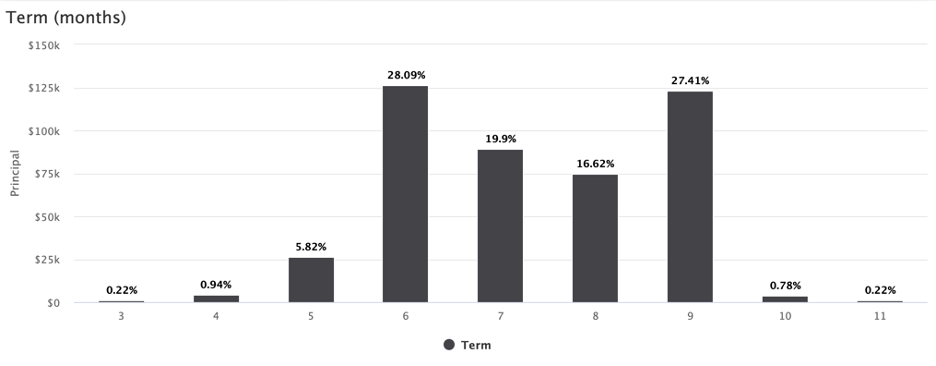

SV Mid-Term Note I – Term (months)

50% of deals have a term of 7 – 9 months.

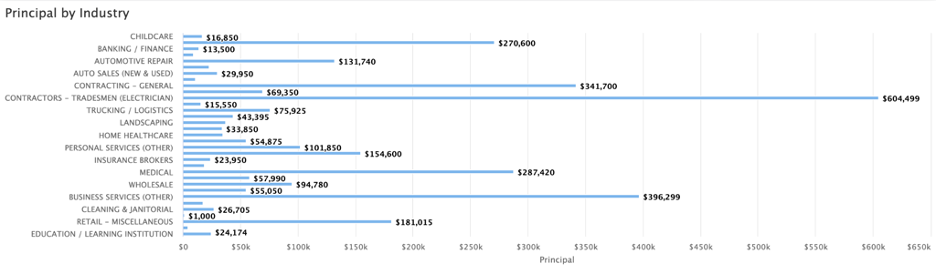

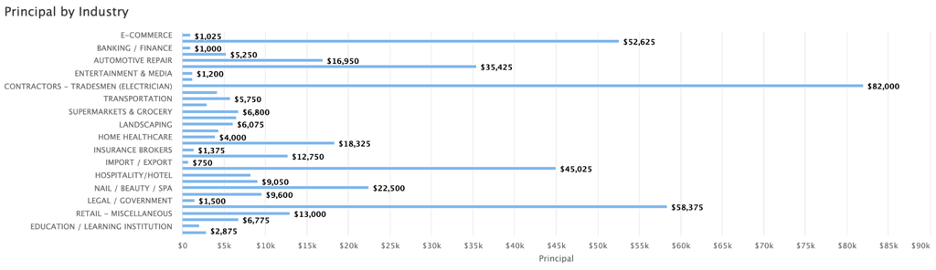

Principal by Industry

Leading industries by AUM are: Contractors – Tradesman (Electrician), Contracting – General, and Business Services (Other)

Principal by FICO

48% or more of the offering is currently invested in deals with FICOs over 700.

SV Short-Term Note I

Min. Investment: $25,000 | Term: 12 Months | Payment Schedule: Monthly

Investor AUM: $573K

(as of 9/30/23)

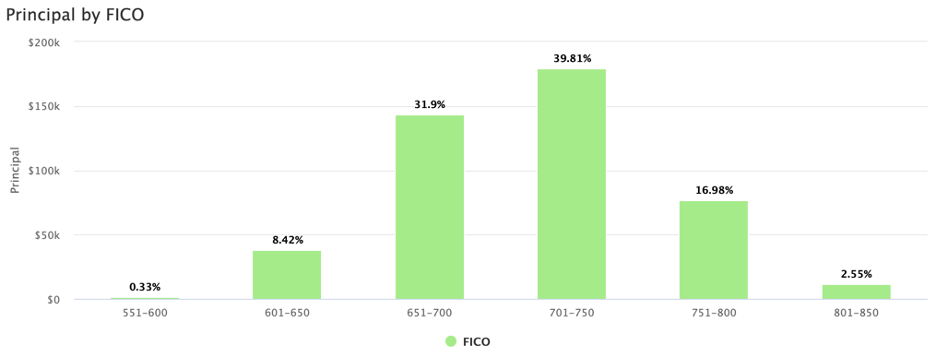

SV Short-Term Note I – Term (months)

65% of deals have a term of 7+ months.

Principal by Industry

Leading industries by AUM are: Contractors – Tradesman (Electrician), Business Services (Other), and Restuarant / Bar / Food Service

Principal by FICO

59% or more of the note is currently invested in deals with FICOs over 700.