Are you an accredited investor or high-net worth individual in your 70s? Find out how to keep growing your wealth.

Retirement doesn’t have to mean slowing down, especially when you want to maintain or increase your income.

In this article, we’ll show you how to continue growing your wealth with the SV Mid-Term Note D. This note can offer you flexibility, predictable returns, and a way to potentially outpace inflation and traditional investments like stocks and bonds.

Why Growth Still Matters in Your 70s

As you enter your 70s, continuing to grow your wealth is important – especially with inflation reducing the purchasing power of retirement savings. According to a 2024 RAND study, inflation erodes the value of single college graduates’ annuities by $18,000 over the course of their retirement.

This financial hit can impact your ability to cover costs like:

- Unexpected medical expenses

- Traveling or fulfilling lifelong goals

- Leaving a larger legacy for loved ones

- Supporting grandchildren’s education

So How Can I Grow My Wealth?

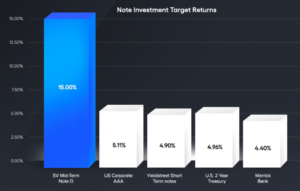

The SV Mid-Term Note D’s 15% annualized return can offer a strong opportunity to outpace inflation. For example, a $100,000 investment would generate $45,000 over three years, with quarterly payments of $3,750—a much better opportunity than letting inflation eat away at your capital.

Plus, the SV Mid-Term Note D can outpace traditional investments too, with target returns approximately three times higher than the 3-year Treasury Rate (as of 6/1/2024).

What Else Can the Note D Offer Me?

● Flexibility

With its short three-year lock-up, the Note D gives you more flexibility than lots of other alternative assets – like private equity which can tie up your money for 10 years or more.

After just three years, you can withdraw your money and use it however you want, whether that’s for a new investment or a personal goal. If you’re happy with your returns and want to keep growing your wealth, you can also roll over your investment—no fuss, no hassle.

● Tax-Deferred Growth

The Note D can fit within self-directed retirement accounts like IRAs or solo 401(k)s, offering you tax-deferred growth.

Because our notes can be included within these accounts, you can benefit from both tax advantages and high returns.

● Security

Each note is backed by a diversified portfolio of merchant cash advances (MCAs), with no more than 1% of the total principal invested in any single MCA deal. This diversification helps mitigate risk.

And if that weren’t enough, our experienced management team has achieved a 100% success rate in delivering target returns.

What can I do now?

The SV Mid-Term Note D can offer you a balanced combination of flexibility, security and a 15% annualized return, making it a potentially attractive option for investors looking to grow their wealth.

Sign up for a free investor account to explore our notes and achieve your financial goals with tax-optimized investments.