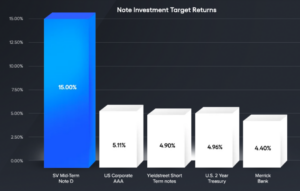

Right now, the target return of a US 2-year Treasury bond is 4.96%. But you could be earning so much more. Our SV Mid-Term Note D offers target returns of 15% — that’s over three times higher (data as of 6/1/2024).

In this blog, we’ll explore how our SV Mid-Term Note D can help you achieve greater returns.

How Can I Find Higher Yields in a Low-Interest Market?

Volatile market conditions are making it harder than ever to secure stable, high-return investments. Take Treasury bonds. They can offer you stability, but they don’t always meet ambitious financial goals. At times, these returns barely keep pace with inflation.

But the SV Mid-Term Note D can offer you another option. With a 15% annualized target return, a $100,000 investment could generate $3,750 in quarterly payments, adding up to $45,000 over three years, plus your principal at the term’s end.

It sure beats barely keeping up with inflation.

So why should I use this alternative asset to achieve higher returns?

● Reliability

Our notes have consistently achieved a 100% success rate in reaching their target returns. Unlike other alts, like venture capital where seven out of ten portfolio companies don’t even return the money invested, you can count on Supervest.

The reason this note can provide such reliable returns is because it’s backed by a well-diversified portfolio of carefully selected merchant cash advances (MCAs). This portfolio is managed by a team of experts who actively adjust the portfolio to minimize risk and maximize stability.

● Flexibility

Investors need flexible strategies. With the SV Mid-Term Note D’s rollover feature, you can continue earning potentially high returns without the hassle of finding new investment opportunities.

After three years, you have the option to reinvest and keep receiving 15% annually, helping your portfolio remain productive.

Or, if you want to withdraw your funds for a new investment or personal expense, like medical bills or college tuition, you can easily retrieve your capital when the term is up.

What can I do now?

In today’s unpredictable market, the SV Mid-Term Note D stands out as a potentially high-yield, reliable, and flexible investment.

Ready to explore this opportunity? Invest in the SV Mid-Term Note D today.

Or, if you’re new to Supervest, sign up for a free investor account to discover the benefits of our Small Business Finance notes.

P.S. Don’t forget our referral deal! Refer someone to Supervest and get an exclusive personalized one-on-one meeting with our Chief Investment Officer, John Donahue, to review your portfolio.